This is a discussion of the "Bollinger Buy the Dip" strategy.

Overview

- Long call diagonal

- 2 legs

Bollinger Buy the Dip Strategy Settings

- Bollinger Buy the Dip Strategy utilizes a custom strategy which is labeled "qa_Diagonal_50-20_CS" under the custom strategy dropdown menu.

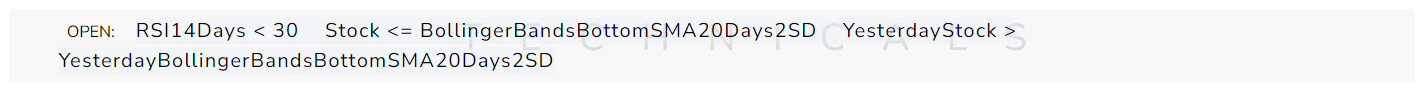

Bollinger Buy the Dip Open Conditions:

- RSI 14 Days below 30

- Stock price crosses down through Bollinger Bands Lower Band

Bollinger Band Setup: SMA 20 Days band width of 2 Standard Deviations

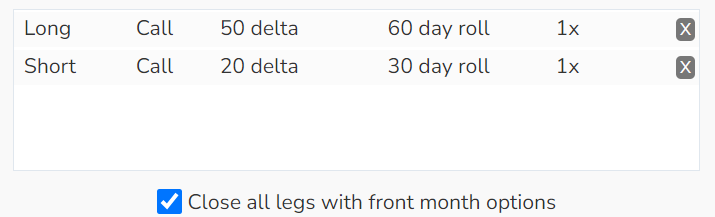

Details on Options TradeMachine is Selecting for Bollinger Buy the Dip Strategy:

- 1x long 50 delta call near 60 days to expiration

- 1x short 20 delta call near 30 days to expiration

Earnings Handling for Bollinger Buy the Dip Strategy:

Bollinger Buy the Dip Close Conditions:

- Options reach expiration (Close all legs with front month options)

Open next trade for Bollinger Buy the Dip: