This is a discussion of the "Spread the Selloff" strategy, also known as the broken wing butterfly credit spread.

CEO Ophir Gottlieb, discusses the importance of having a long-term focus and a trading plan in order to be a successful trader. Ophir takes a deeper look at the Spread the Selloff, also known as the broken wing butterfly credit spread (1x3x2), in this video. He explains the Spread the Selloff strategy, which involves trading put options on stocks that are in a correction, in technical failure, and have downside tail moves. He concludes by explaining how to set up alerts for this strategy in specific stocks and sectors.

Overview

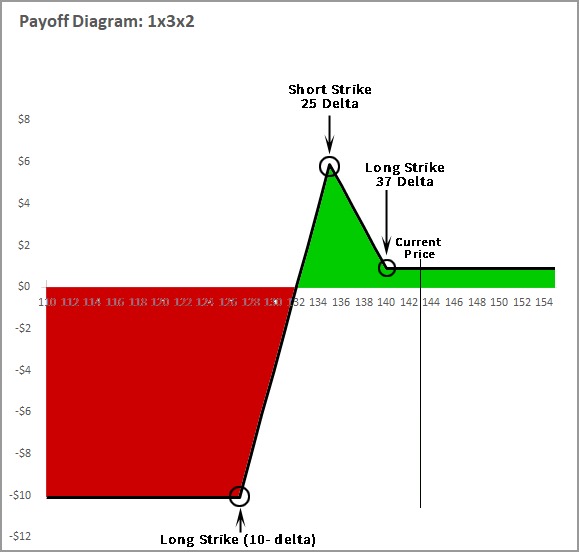

- 1x3x2 short put broken wing butterfly

- 3 legs

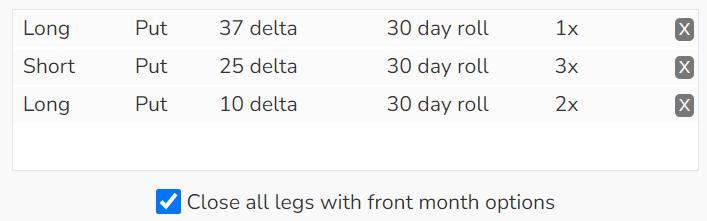

Spread the Selloff Strategy (aka: 1x3x2 or Broken Wing Butterfly Credit Spread) Settings

- Spread the Selloff Strategy utilizes a custom strategy which is labeled "CML Spread the Sell-Off (Put 1x3x2)" under the custom strategy dropdown menu.

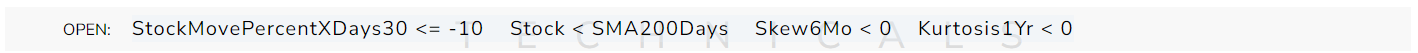

Spread the Sell-off (aka: 1x3x2 or Broken Wing Butterfly Credit Spread) Open Conditions:

- In last 30 days, stock moved down -10% or more

- Stock is below SMA 200 Days

- 6 month asymmetry (skew) of up vs down stock returns below 0

- In the last year, the kurtosis (tailedness) of the stock returns has been below 0

Details on Options TradeMachine is Selecting for Spread the Selloff Strategy (aka: 1x3x2 or Broken Wing Butterfly Credit Spread):

- 1x long 37 delta put near 30 days to expiration

- 3x short 25 delta puts near 30 days to expiration

- 2x long 10 delta puts near 30 days to expiration

Earnings Handling for Spread the Selloff (aka: 1x3x2 or Broken Wing Butterfly Credit Spread) Strategy:

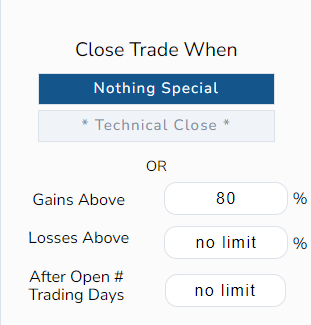

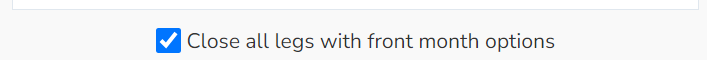

Spread the Sell-off (aka: 1x3x2 or Broken Wing Butterfly Credit Spread) Close Conditions:

- Gains Above 80%

- Options reach expiration (Close all legs with front month options)

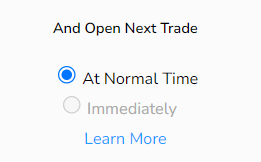

Open next trade for Spread the Sell-off (aka: 1x3x2 or Broken Wing Butterfly Credit Spread):

Spread the Selloff Payoff Diagram (aka: 1x3x2 or Broken Wing Butterfly Credit Spread) - At Expiration