"Getting Started with the Today tab" explores the Today tab of TradeMachine® in detail, covering the strategies, goals, requirements, and FAQs for this feature of TradeMachine®.

What is the Today Tab?

The Today tab has a selection of prebuilt technical strategies that scan all U.S. exchanges at a minimum of every 30 minutes during market hours.

Like alerts, these strategies are scanned intraday - so once a ticker appears there it will remain there for the rest of the day and the following 2 trading days, even if the technical conditions change later in the trading day.

In the video below, our CTO, the lead architect and engineer that created TradeMachine from scratch, discusses all of the nuances of the Today Tab within TradeMachine.

The Today Tab is everything you could want on one screen.

Navigating and Filtering the Today Tab

There are several ways to view the data provided within the Today Tab, as well as ways to filter the results provided on the Today Tab.

Viewing Options

At the top left of the Today Tab, you can select your preferred viewing method for the page, either in table formatting or in list format, using these buttons:

Filtering Options

There are also several options to filter the results.

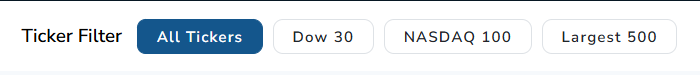

The "Ticker Filter" option at the top left of the Today Tab, you can filter by All Tickers, tickers in the Dow 30, tickers in the Nasdaq 100, or by the Largest 500 tickers by market cap.

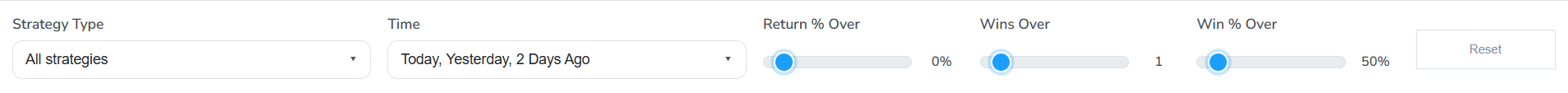

Additionally, you can access additional filters using the "Filter" button at the top right of the Today Tab:

From there, you can filter by:

- Strategy Type

- Time

- Return % Over

- Wins Over (number of wins)

- Win % Over (win %)

For TradeMachine® Platinum subscribers, there is an additional filtering option based on Liquidity.

If you would like to learn more about how TradeMachine® defines each liquidity level for this filter, you can do so here: Liquidity Filtering in TradeMachine®

If you are not currently a TradeMachine® Platinum subscriber, but would like to access this filter, you can learn how to upgrade your subscription here: Upgrading to TradeMachine® Platinum

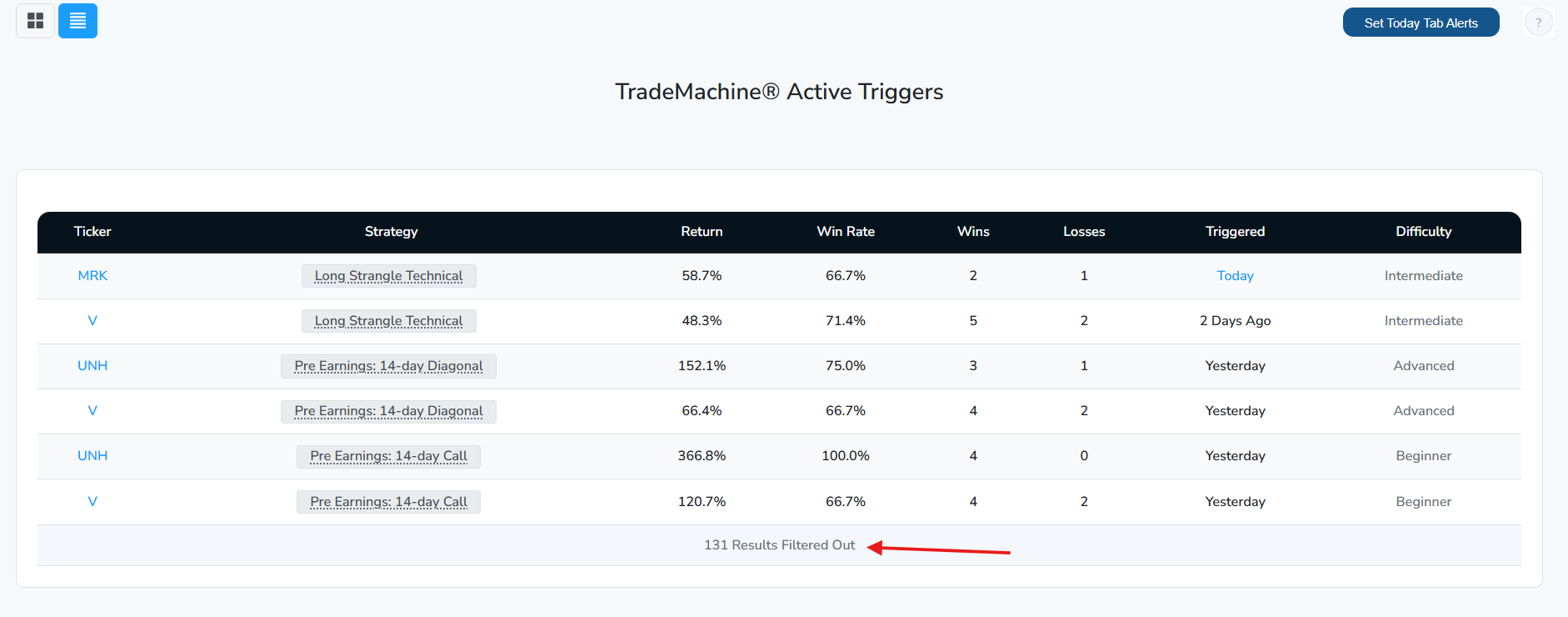

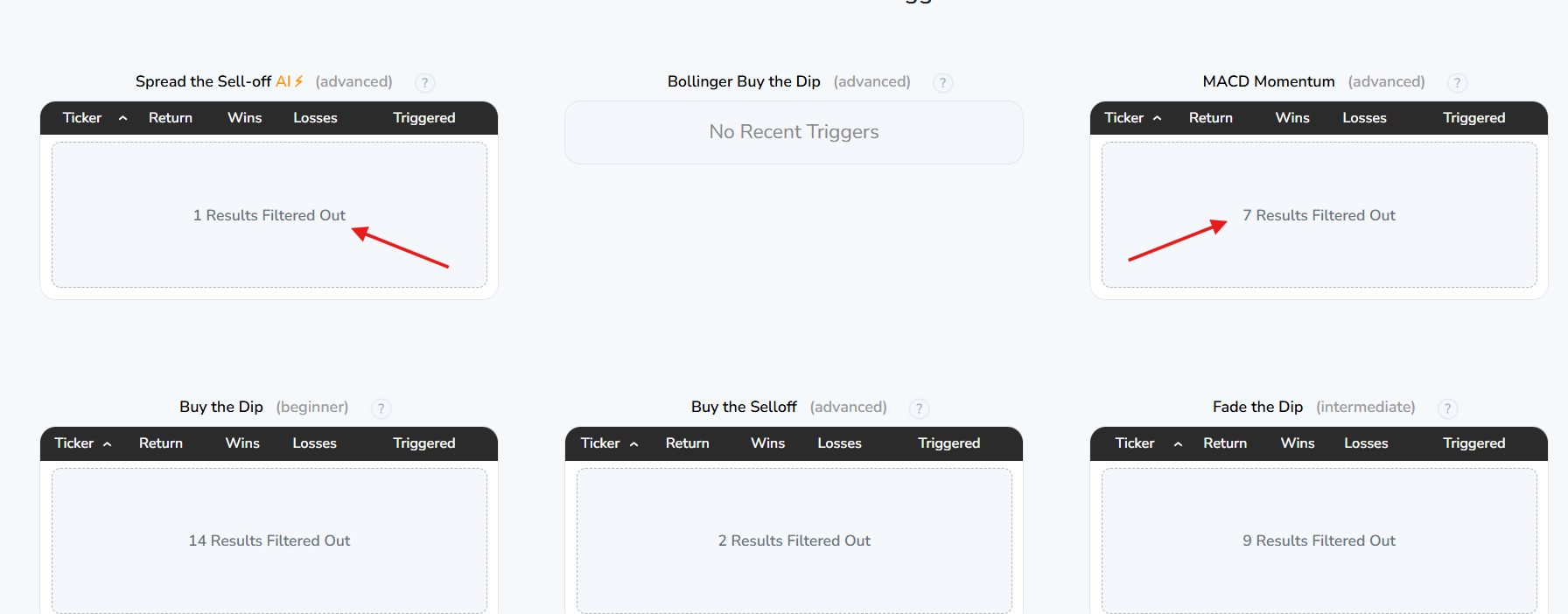

When using any of the filtering options, whether in table or list view, if there are results that are not being shown a message will show below all triggers.

Goal

To find actionable backtests during the trading day in one place, in real-time.

First: The tab shows all backtests that trigger on the day from 14 of the pre-built TradeMachine® scans. The scanned strategies are:

-

Bollinger Buy the Dip (explain -> Password: macdmomo)

-

MACD Momentum (explain -> Password: macdmomo)

-

Buy the Sell-off (explain -> Password: selloffmodel)

-

Buy the Dip (explain)

-

Fade the Dip (explain)

-

Long Strangle Technical (explain)

-

Bullish Bursts (explain)

-

Bearish Bursts (explain)

-

Pre-Earnings: 14-day Diagonal (example)

-

Pre-Earnings: 3-day Call (explain)

-

Pre-Earnings: 7-day Call (explain)

-

Pre-Earnings: 14-day Call (explain)

-

Post Earnings: Short Put Spread (example)

Requirements

For a backtest to qualify for a trigger, it must show a win rate above 50% for both the one-year and three-year time periods, and at least 2 wins total over three-years. There are also requirements for percent gain, which vary by scan type, but are at a minimum of 15% over 1-year.

Second: Beneath the scan results you will find a comprehensive earnings calendar which allows for examination of earnings by day, week, and month, with verified and unverified earnings dates denoted.

An unverified earnings dates is one in which our data provider (Wall Street Horizon) has not been able to confirm an exact date and offers an estimate until some future time when an exact date can be determined.

A verified earnings date is one in which our data provider (Wall Street Horizon) has been able to confirm a company press release or announcement of a specific date and time for earnings.

Notable Technical Breakouts

The "Notable Technical Breakouts" section is for generating new ideas -- these are not fully completed and back-tested strategies. Once a ticker meets those technical requirements it will appear on the "Today" tab and remain there for 3 trading days (today, and two days after the initial trigger) - so once a ticker appears there it will remain there even if the technical conditions change later in the trading day or the follow two trading days.

In order to fully compose a back-test from that section, click the ticker to open the 'Create' tab. Once on the "Create" tab, click the "Test Trigger" button in the upper right corner, which will then load that strategy in the "Backtest" tab.

From there, you can compose your strategy. Once your strategy is complete, simply click the "Add Alert" button in the upper right hand corner of the back-test to save an alert and be notified any time your conditions are met for that ticker in the future.

The scanned strategies are:

- Pre Earnings: 7-day Momentum - Long Stock

- Pre Earnings: 14-day Momentum - Long Stock

- Big Bollinger Recovery Breakout

- Small Bollinger Recovery Breakout

- Small Bollinger Upside Breakout

- Classic Oversold

- CML Oversold

- MACD Breakout

- Three Inside Up with RSI

FAQs

- Why are you only using these scans? Are the other scans not as good?

We have started with the most commonly used scans in Trade Machine but will likely expand the "Today" tab to include more strategies from the Pro Scanner.

- How often does this page update?

The scanning starts at 7am PT / 10am ET

The requirements for a scan to trigger are checked with real time data every 30 minutes. So you should start seeing the new triggers appear on the Today tab around 7:30 am PT / 10:30 am ET.

- When does a backtest actually trigger?

The mechanics of the TradeMachine® are that it uses end of day prices (about 15 minutes before market close) for every backtest entry and exit (every trigger). That means a backtest only triggers if the end of day prices satisfy the requirements for that strategy.

- Does this replace my own scans?

Not at all! You are encouraged to continue creating your own scans and follow them as well for further trade analysis. This is a convenience and an addition to your Trade Machine experience -- not a replacement.