This is a discussion of the "Pre Earnings: 3-day, 7-day, and 14-day Call" strategies.

Overview

- Long call

- 1 leg

Pre Earnings: 3-day, 7-day, and 14-day Call Strategies Settings

Pre Earnings: 3-day, 7-day, and 14-day Call Open Conditions:

- Stock above 50-day SMA

- According to Custom Earnings section.

- 3-days before earnings

- 7-days before earnings

- 14-days before earnings

Details on Options TradeMachine is Selecting for Pre Earnings: 3-day, 7-day, and 14-day Call Strategies:

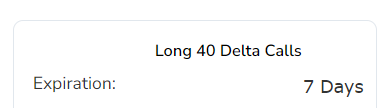

3-days and 7-days:

- 1x long 40 delta call near 7 days to expiration

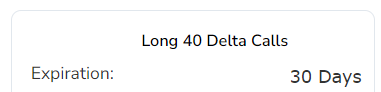

14-days:

- 1x long 40 delta call near 30 days to expiration

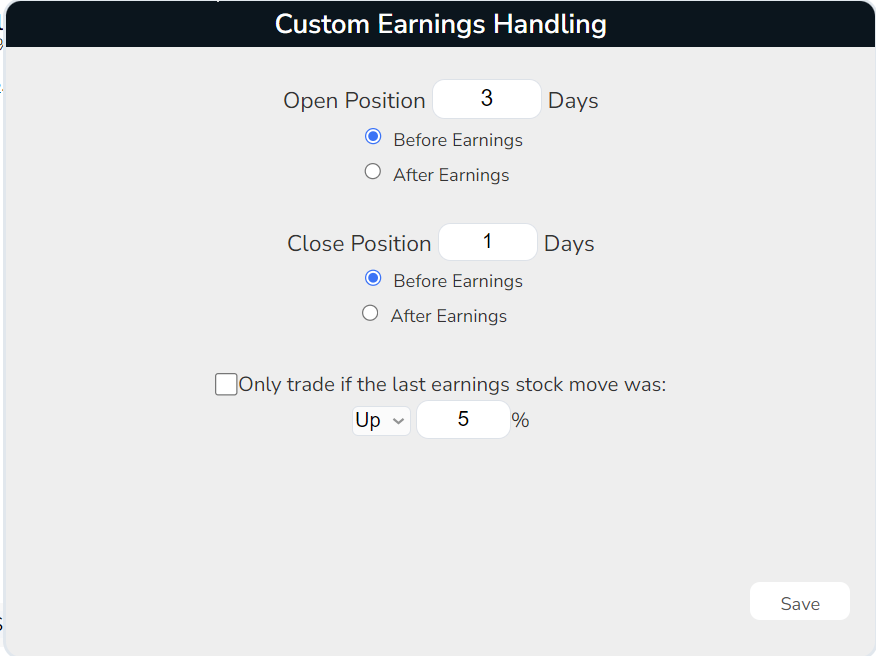

Earnings Handling for Pre Earnings: 3-day, 7-day, and 14-day Call Strategies:

- Custom earnings. Below is each custom earnings setting:

3-day:

- Open position 3 days before earnings.

- Close position 1 day before earnings.

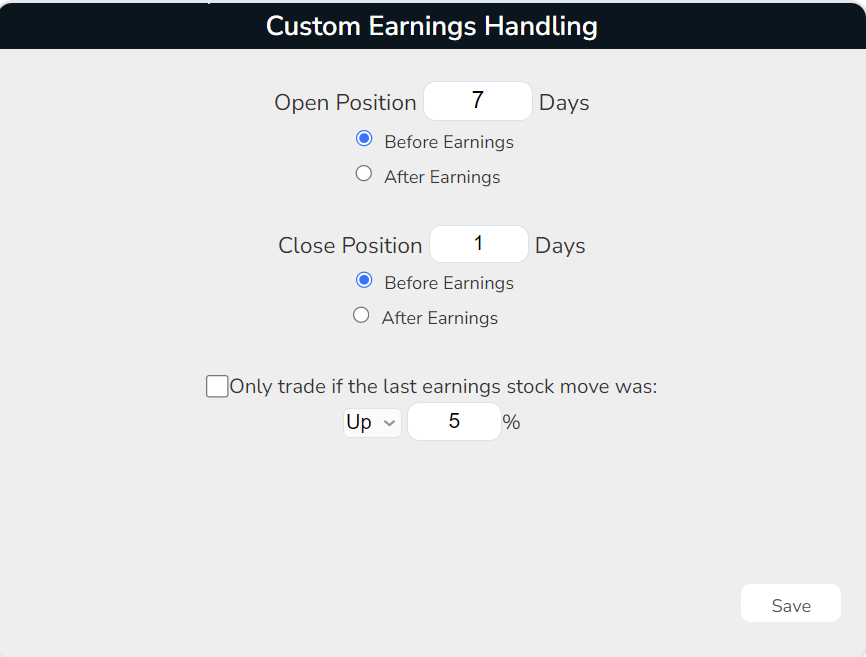

7-day:

- Open position 7 days before earnings.

- Close position 1 day before earnings.

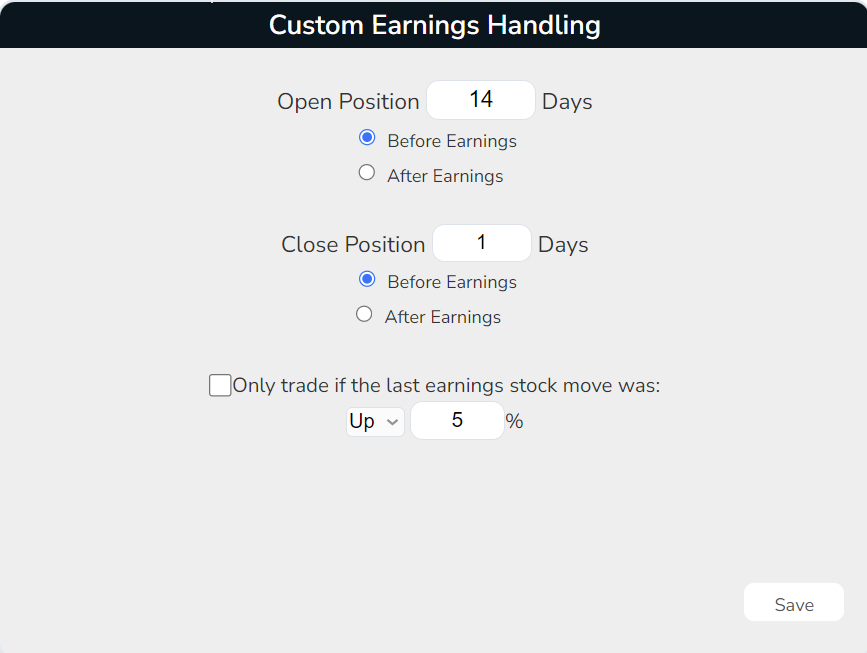

14-day:

- Open position 14 days before earnings.

- Close position 1 day before earnings.

Pre Earnings: 3-day, 7-day, and 14-day Call Close Conditions:

- Close 1-day before earnings

- Gains above 40%

- Losses above 40%

- Options reach expiration (Close all legs with front month options)

Open next trade for Pre Earnings: 3-day, 7-day, and 14-day Call: