This is a discussion of the "Bullish Bursts" strategy. See the best combination of moving averages and RSI that have outperformed the market over 10-, 5-, 3-, 2-, and 1-year, as well as during the Great Recession with a bullish strategy.

Overview

- Long call

- 1 leg

Bullish Bursts Strategy Settings

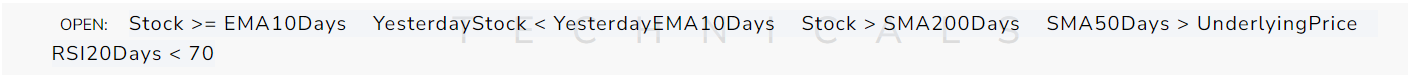

Bullish Bursts Open Conditions:

- Stock price crosses up through 10-day EMA

- Stock is above the 200-day SMA

- 50-day SMA is above the stock price

- 20-day RSI is below 70

Details on Options TradeMachine is Selecting for Bullish Bursts Strategy:

- 1x long 40 delta call near 14 days to expiration

Earnings Handling for Bullish Bursts Strategy:

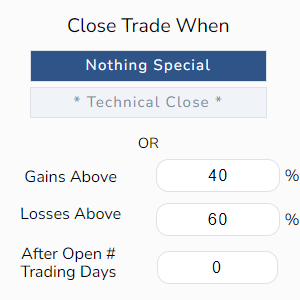

Bullish Bursts Close Conditions:

- Gains are above 40%

- Losses are above 60%

- Options reach expiration

Open next trade for Bullish Bursts: