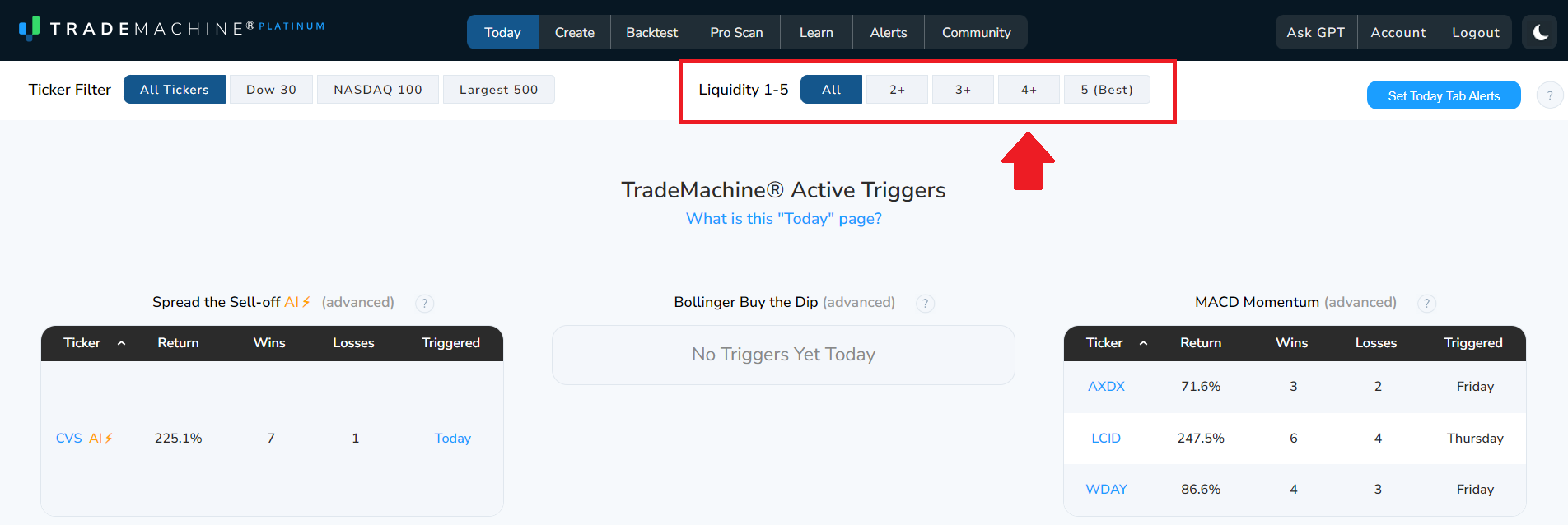

This article discusses the definition of liquidity in regard to options and introduces the liquidity filter feature that is available for TradeMachine Platinum subscribers.

What is liquidity?

Liquidity refers to how readily an asset can be bought or sold in the market. For options, liquidity is determined by two things, and two things only: (i) the width and (ii) the depth of the market. While many point to open interest or volume in options to determine liquidity, that is incorrect - those are derivative measures that may reflect liquidity at times, but are not the defining characteristics. An option can see great trading volume or have large open interest and still be illiquid - a wide and shallow market. Alternatively, an option can have no volume and no open interest, but still show great liquidity with a tight and deep market.

Illiquid options are contracts that are difficult to sell quickly and convert into cash. These options carry higher risks, including wider bid-ask spreads, making it challenging for investors to sell them at a fair market price. Often, investors may have to retain these contracts until expiration.

How is liquidity utilized within TradeMachine®?

TradeMachine® uses a proprietary calculation based on bid-ask spread and the underlying price to determine option liquidity on a scale from 1-5 with 5 being the most liquid.

Here is how TradeMachine® determines liquidity:

- If the spread is less than or equal to $0.05, or if it's less than or equal to 0.0025 times the stock price, assign a score of 5.

- If the spread is less than $0.10, or if it's less than or equal to 0.005 times the stock price, assign a score of 4.

- If the spread is less than $0.20, or if it's less than or equal to 0.01 times the stock price, assign a score of 3.

- If the spread is less than $0.50, or if it's less than or equal to 0.03 times the stock price, assign a score of 2.

- If none of the above conditions are met, assign a score of 1.

- If the stock price is less than $5 and the final score calculated is more than 3, adjust the final score to 3.

- The liquidity filter looks at the closest options to 30 days to expiration. It looks at the 25 Delta options for calls and puts and then that is averaged.