-

When choosing which strike option to trade based on the delta, the system will select the first strike based on the closest delta for that strike, so, simple and as the user expects.

-

When choosing the second option, some rules apply:

a. If the delta is the same, the strike must be the same

b. If the delta is higher on the second option for a call option, the strike must be lower on the second option. (calls with lower strikes have higher deltas).

If the delta is higher on the second option for a put, the strike on the second option has to be higher.

c. If the delta is lower, the logic from b. is reversed (lower delta, higher strike call. lower delta, lower strike put).

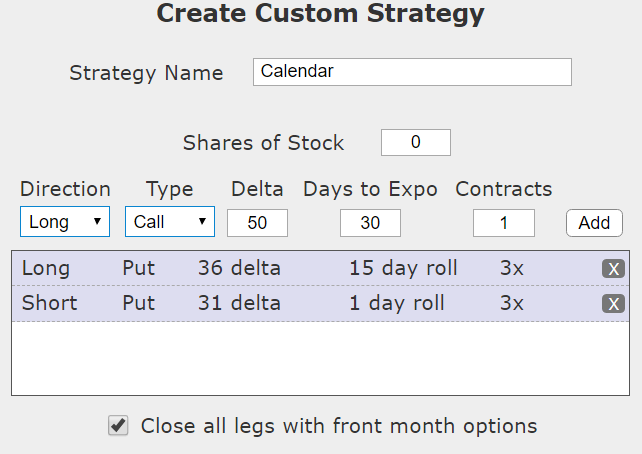

Here is an example multi-leg custum strategy:

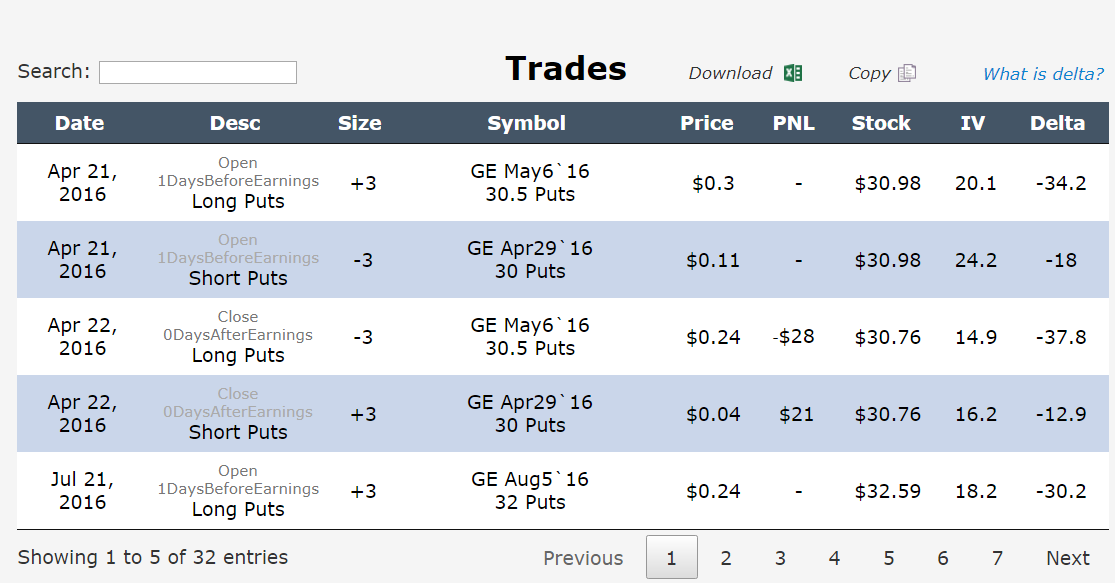

And here are some trade results from the back-tester using that custom strategy above:

In the example above, the reason the delta looks funny is because:

-

The first option chosen is very close to the desired 36 delta put.

-

The second option chosen has a lower requested put delta, and so therefor must have a lower put strike. The system correctly chose the next strike down from 30.5 which is 30. In this case, because the timing of the expiration is only a few days away, the delta is very low (-18) because of how options math works, there is only about an 18% chance that the 30 level put will end up in-the-money within 8 days with stock at $30.98.

When thinking threw the implications of all of the logic, one will come to the conclusion that this is the desired functionality to prevent a situation where the user is trying to do a diagonal spread and ends up with the wrong strike being higher.