What Do the "1 Day After Earnings Jump, Long Call" and "1 Day After Earnings Drop, Long Put" scans do?

These are two scans which look for the same thing -- a pattern of continued stock movement within a short window of time right after an abrupt stock drop or stock rise off of an earnings result.

1 Day After Earnings Jump, Long Call

Pattern recognition is critical to option trading. One of the many patterns we scan for is best seen in Apple. Here's what it looks like, at a glance:

THE PATTERN

If you've ever seen a stop rip off of earnings and wondered if that was a signal for a trade, or if the momentum would continue, then this is exactly the back-test you are after. We call it "star gazing" when a stock rips and we're stuck -- with no idea what to expect next.

If the stock move immediately following an earnings result was large (3% or more to the upside), if we test waiting one-day after that earnings announcement and then bought a three-week at the money (50 delta) call, the results can be quite strong.

We can test this approach without bias with a custom option back-test. Here is the timing set-up around earnings:

Rules

- Condition: Wait for the one-day stock move off of earnings, and if it shows a 3% gain or more in the underlying, then, follow these rules:

- Open the long at-the-money call one-trading day after earnings.

- Close the long call 14 calendar days after earnings.

- Use the options closest to 21 days from expiration (but more than 14 days).

This is a straight down the middle direction trade -- this trade wins if the stock is continues on an upward trajectory after a large earnings move the two-weeks following earnings and it will stand to lose if the stock does not rise. This is not a silver bullet -- it's a trade that needs to be carefully examined.

But, this is a conditional back-test, which is to say, it only triggers if an event before it occurs.

Example

You can read a full example, looking at Apple, here: Pattern Identification: How to Trade Apple After an Earnings Beat

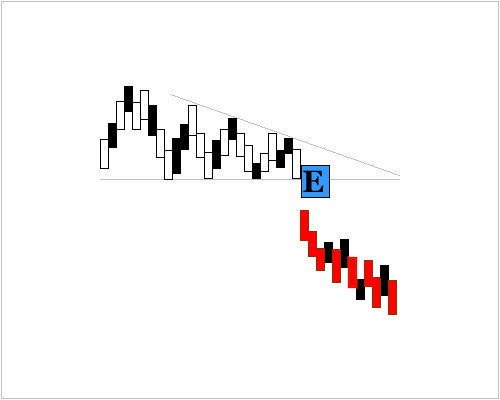

1 Day After Earnings Drop, Long Put

This follows the same guidelines, but rather than look for an earnings rise, it looks for a stock that has fallen by 3% or more after earnings and then tests the performance of a long put for the same time period as the "1 Day After Earnings Jump, Long Call" scan.

In fact, all of the rules are the same -- it's just a test of bearish momentum rather than bullish.

One of the great benefits of this strategy is that it allows us to scan for names where the market is immediately showing movement and then to back-test it.