This is a discussion of the Backtest Tab within TradeMachine including details on the features and options available within that tab.

How to Use the Backtest Tab

Navigating the Backtest Tab

Backtest Time Frame

You can manage the backtest test length a couple of ways.

- By clicking on the time frames listed next to "Test Length" on the top left of the Backtest tab.

- Using the date boxes labeled "Start" and "End" to set a customized timeframe.

Backtest links remain static to preserve the original settings, this means that when loading triggers from the Today tab or an alert email, you may see an end date for the backtest in the past. If that is the case, the end date will be highlighted in yellow. You can update the end date using either of the previously mentioned methods.

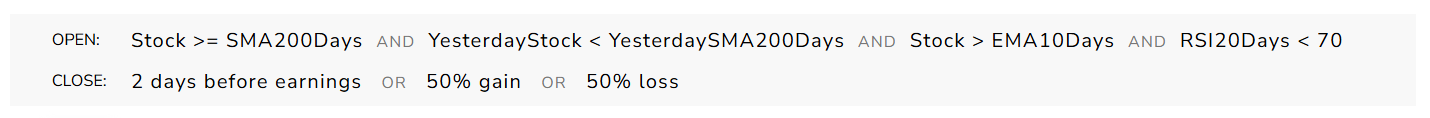

Understanding Set Technical Open and Close Conditions for the Strategy

Under the backtest tile you can see a list of the selected technical open and close settings for the backtest.

Technical Open: For TradeMachine® to consider a trigger "active", all technical conditions must be met. TradeMachine® uses AND logic for the technical open.

Technical Close: However, for the close,TradeMachine® uses OR logic. So once any single one of of the close conditions are met, TradeMachine® will close the trade at the end of the day the condition was met.

Features of the Backtest Tab

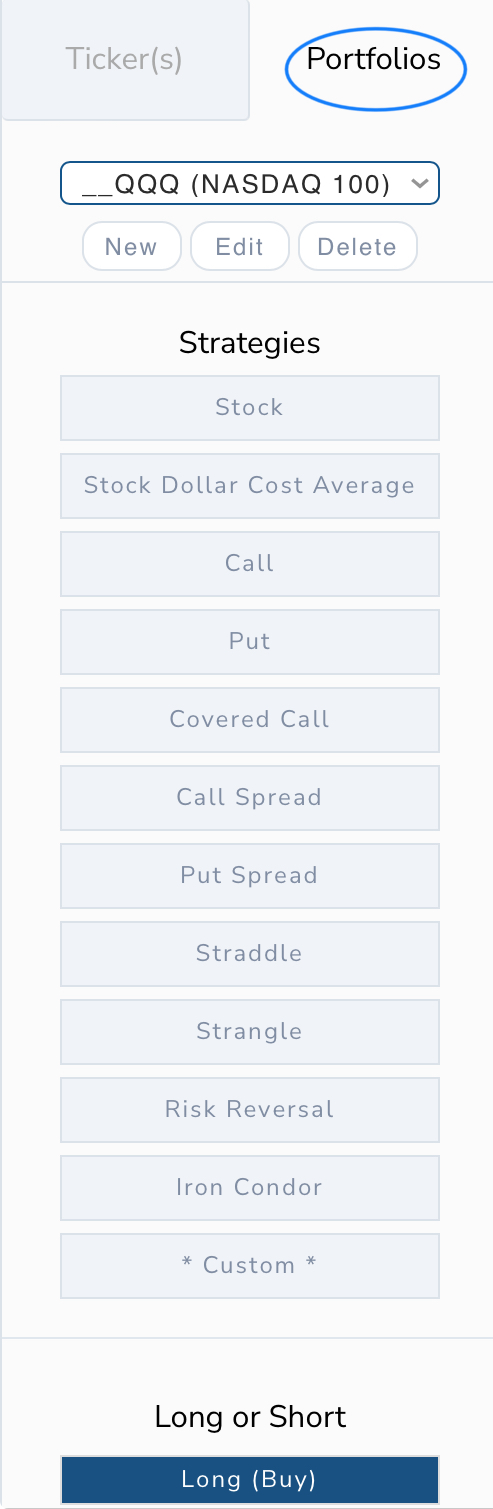

Portfolios

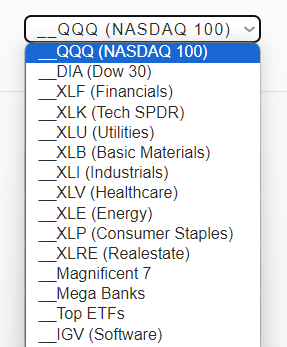

TradeMachine features 15 pre-built portfolios spanning industries, indices, and ETFs. These are automatically loaded into every user's account and are not able to be removed or edited.

The CML provide Portfolios can be identified by the preceding { __ } in the portfolio name and include:

- QQQ

- DIA

- XLF

- XLK

- XLU

- XLB

- XLI

- XLV

- XLE

- XLP

- XLRE

- Magnificent 7

- Mega Banks

- Top ETFs

- IGV

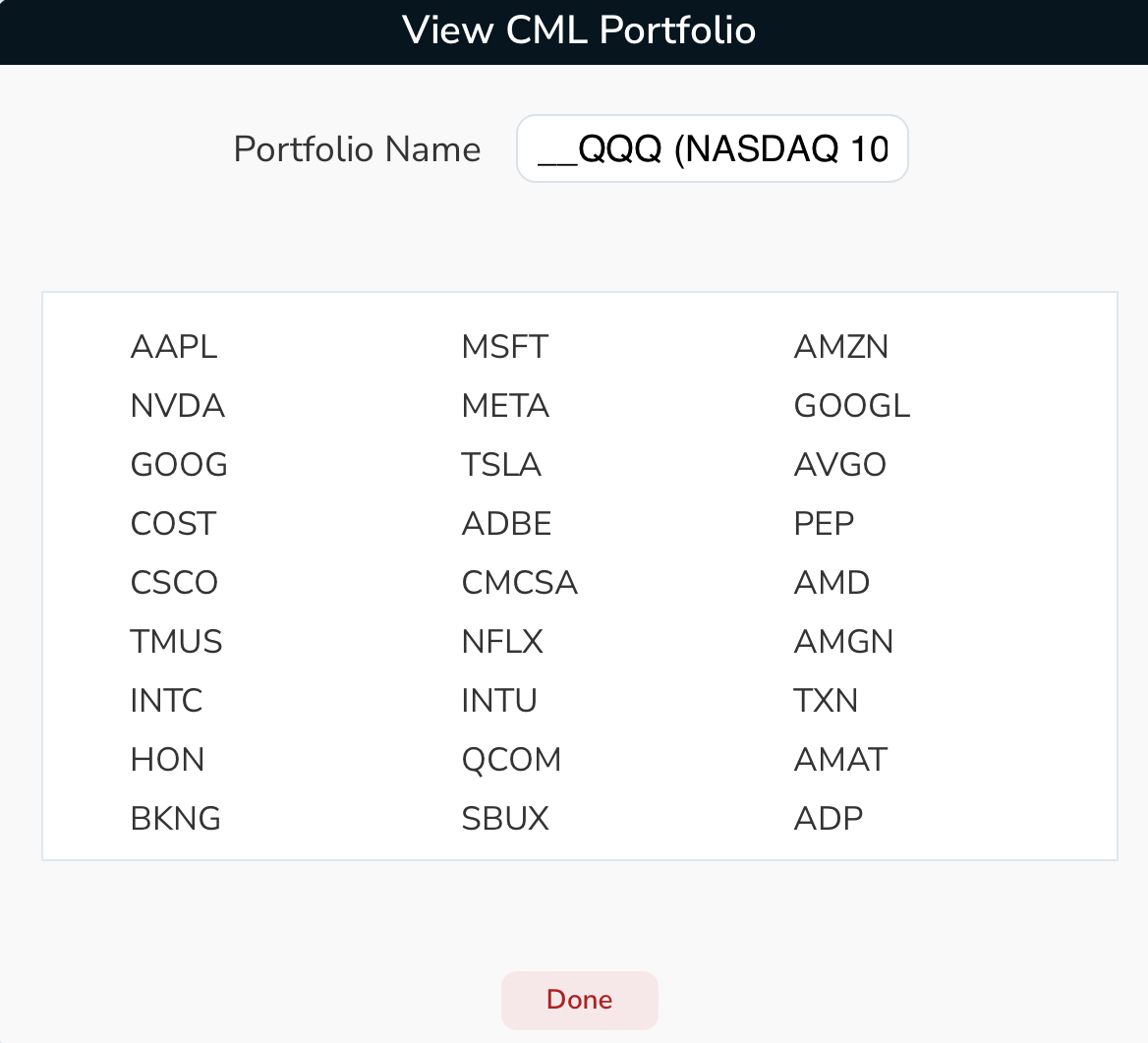

Although, these portfolios cannot be edited, if you select the edit button, you can view the entire list included tickers as a preview:

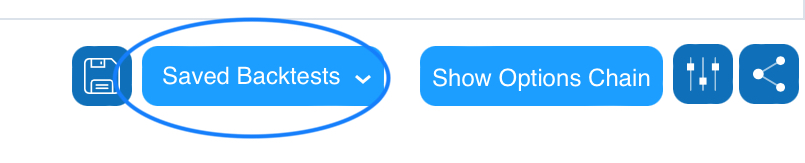

Saved Backtests

Saved backtests allow you to save the entire backtest setup, including dates, technicals, stops and limits, deltas, tickers, strategy type, etc. Quickly reference your saved backtests or choose one of the CML Backtests which correspond to the strategies on the Today Tab.

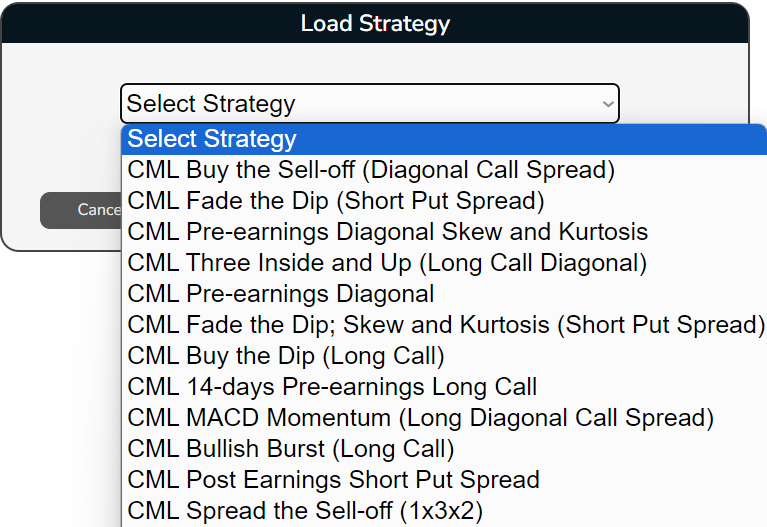

TradeMachine features 12 pre-built strategies in Saved Backtests. These are automatically loaded into every user's account and are not able to be removed or edited.

The CML pre-built strategies include:

- CML Buy the Sell-off (Diagonal Call Spread)

- CML Fade the Dip (Short Put Spread)

- CML Pre-earnings Diagonal Skew and Kurtosis

- CML Three Inside and Up (Long Call Diagonal)

- CML Pre-earnings Diagonal

- CML Fade the Dip; Skew and Kurtosis (Short Put Spread)

- CML Buy the Dip (Long Call)

- CML 14-days Pre-earnings Long Call

- CML MACD Momentum (Long Diagonal Call Spread)

- CML Bullish Burst (Long Call)

- CML Post Earnings Short Put Spread

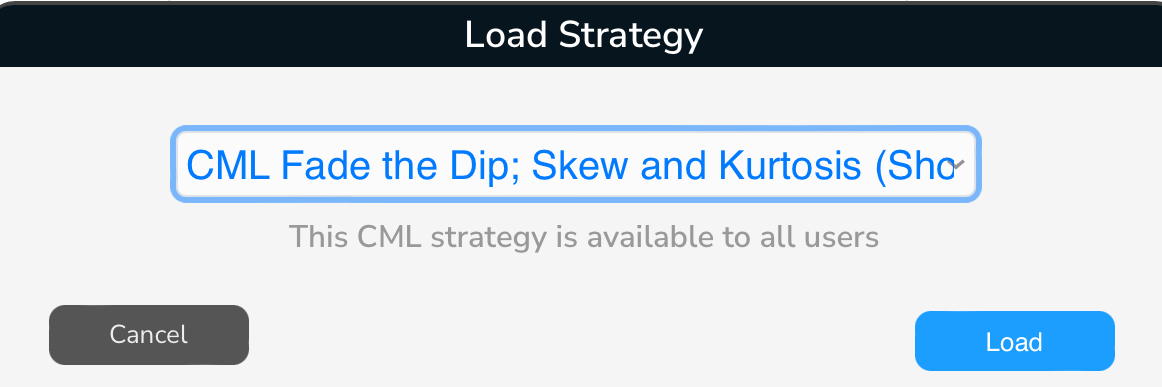

The CML provided strategies can be identified by “CML” at the beginning of the strategy name and will display a message when loading the strategy:

Adding an Alert

With just the click of a button, users can add alerts for all or part of the tickers of a backtest so that they are notified via email and/or text message when an alert has been triggered.

Here is a 1:30 video that explains how to add alerts from the Backtest tab:

The Backtest tab will only show the Add Alerts button at the top right of the backtest when there are alertable conditions set. If there are no technical conditions or custom earnings conditions set on the backtest, this button will not appear.

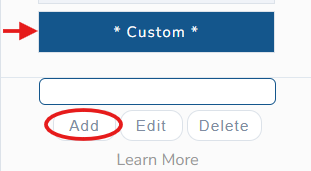

Building Custom Multi-legged Strategies

The custom strategies section is a place to create your own strategies with different expirations and deltas, up to four option legs. Name the strategy and select it in the future to quickly load the position again.

TradeMachine allows users to create up to four-legged strategies including diagonals, butterflies, broken butterflies, iron condors, etc.

By selecting custom in from the strategy options and then "Add" you can begin building your own strategies to backtest in TradeMachine.

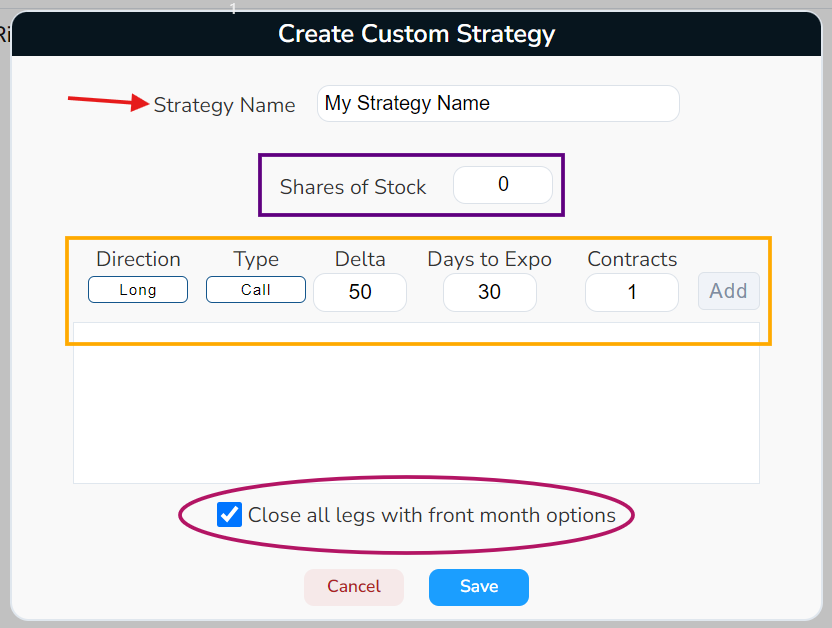

When the Custom Strategy window appears, there are a few details that you will set for the custom strategy:

- Name the strategy: This is important because the strategy will be saved in the Custom Strategy drop down menu. Naming the strategy with something unique will help you locate it in the future.

- Shares of Stock: If the strategy includes buying a number of shares of stock, enter that information for it to reflect in the backtest(s). The default setting here is 0.

- Enter each leg of the strategy: There are 5 pieces of information that are required for each leg of the strategy. Repeat this step for each leg of the strategy, TradeMachine can backtest up to 4 legged strategies.

- Direction: Long or Short

- Type: Call or Put

- Delta

- Days to Expiration

- Number of Contracts

- Check or uncheck the box to "Close all legs with front month options".

Once all details are entered, select the "Save" option and this strategy is ready to use for backtesting.

When reviewing a custom strategy at a later time, or one that was shared by CML or another user, the details of each leg of the strategy can be reviewed by selecting the "Edit" button. This will allow the user to see all of the strategy details.

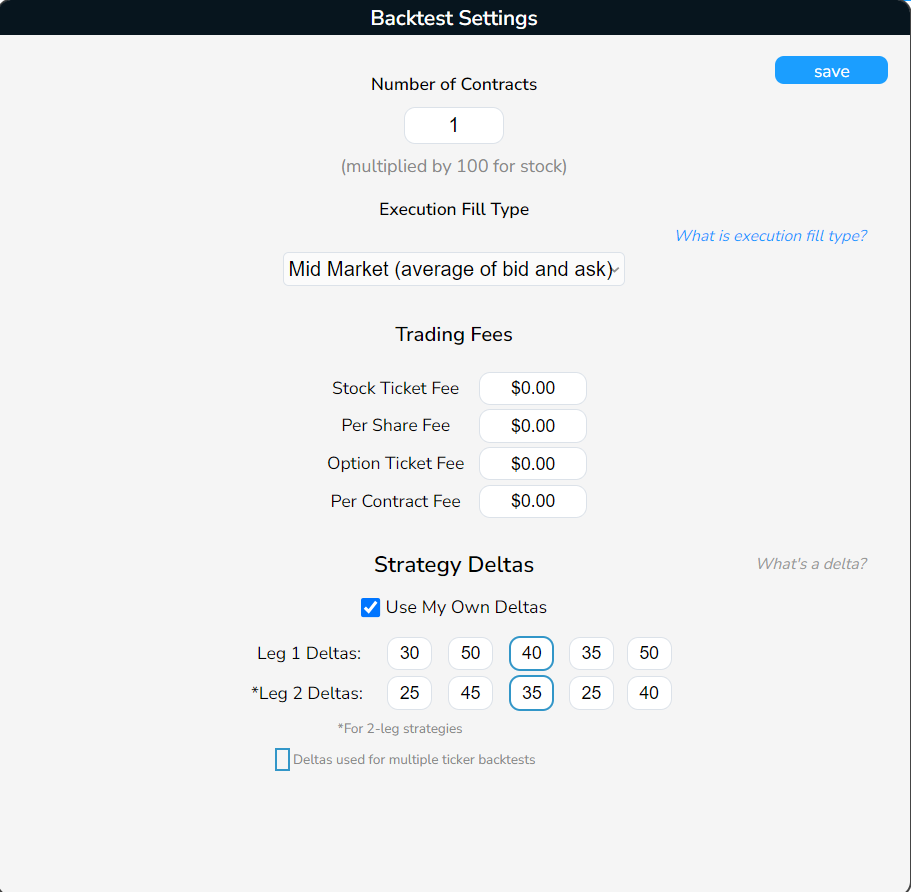

Specify Deltas

Users can set deltas for the backtest, rather than using what is pre-set by TradeMachine. To alter the deltas for a backtest, select the settings menu:

When doing a single ticker backtest, the deltas reflected in each of the respective boxes will have their own backtest tile designated on the backtest. When doing a multi-ticker, or a single ticker followed by a comma, backtest only the deltas in the middle boxes (surrounded by the blue box) will be displayed.