This is going to define and describe the use of adjusted close pricing and the applications within TradeMachine®.

TradeMachine® Moving Average Calculations

We use the adjusted close price for all of our moving average calculations with real-time data - which is a more nuanced approach that reflects what the stock is actually trading at today (taking into account corporate actions like dividends, stock splits, etc.).

Many other services use the close price (unadjusted) or pick and choose which corporate actions to include in their adjusted close price which can cause discrepancies between our moving average calculations and theirs.

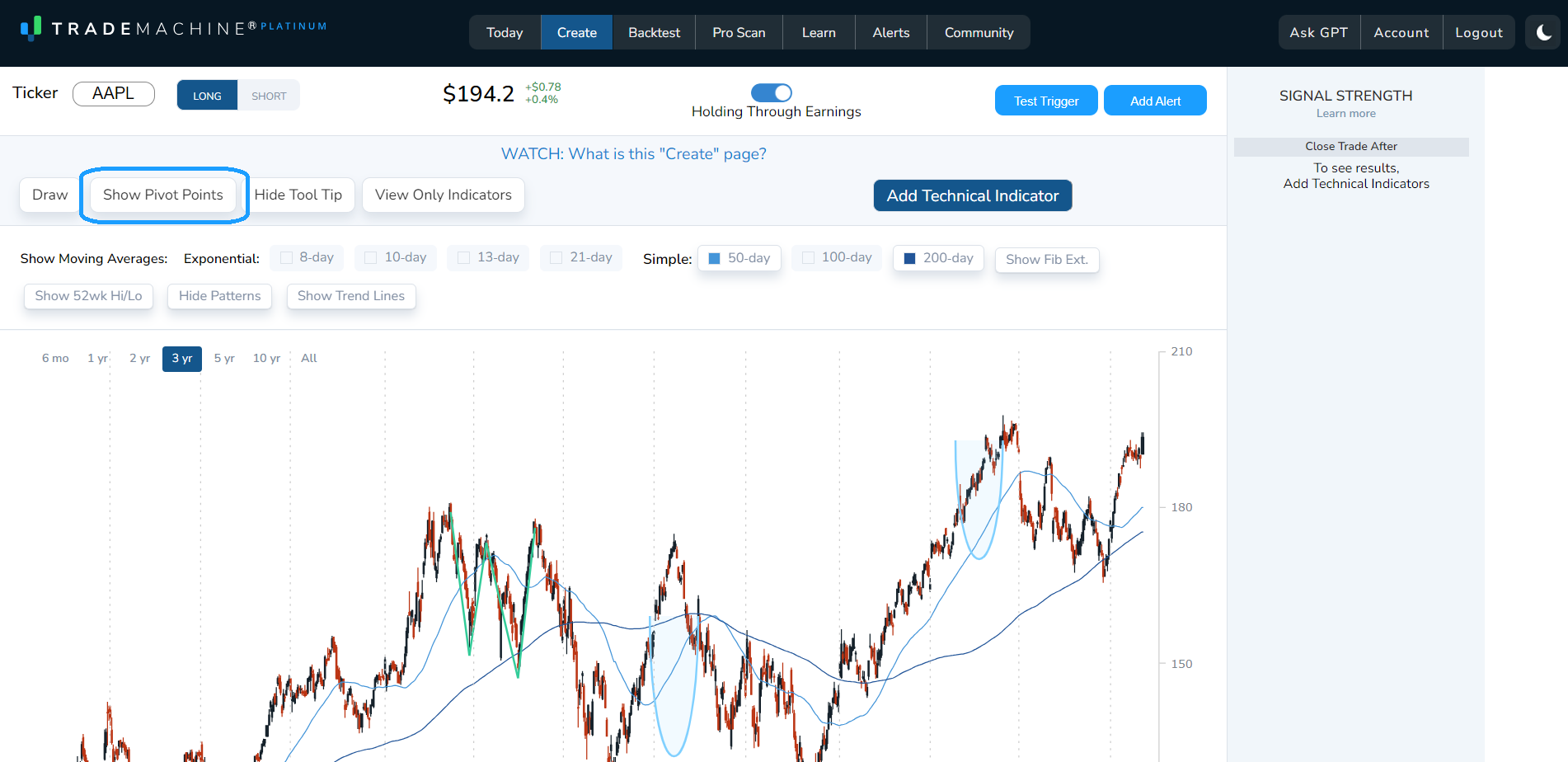

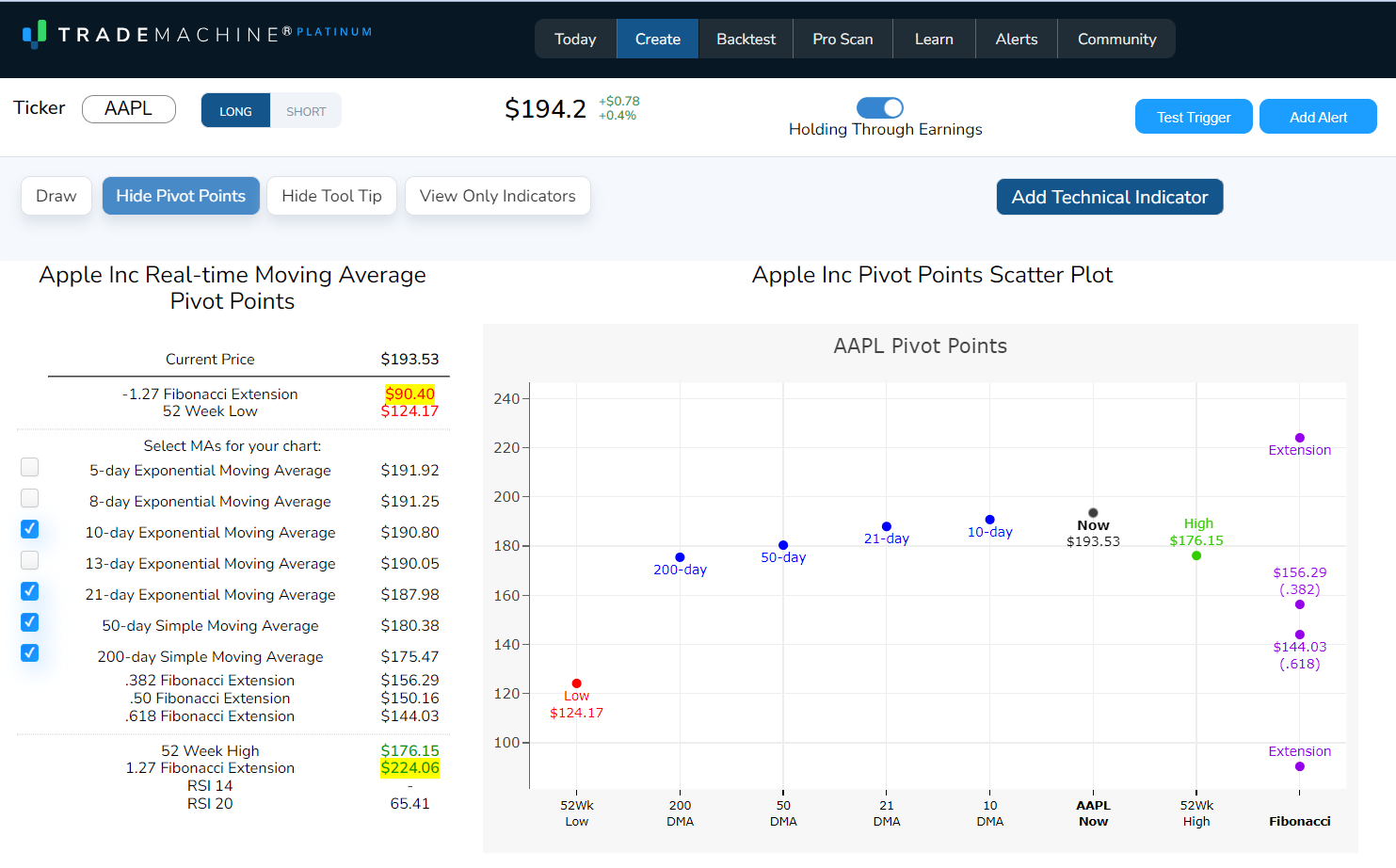

We have a handy tool to make checking those moving average trigger conditions near end of day easier, you can find this on the “Create” tab by clicking “Show Pivot Points”. This site is using the exact calculations used in TradeMachine® with real time data (updated between every 1-5 seconds).

What is the Adjusted Close Price?

The adjusted close price is a modification made to the closing price of a stock to account for various corporate actions that may affect the stock's value. This adjustment is crucial for accurate historical analysis and performance measurement. Let's break down the concept in detail:

Closing Price:

The closing price of a stock is the last traded price recorded at the end of a trading day. It's the price at which the final transaction occurred before the market closed.

Corporate Actions:

Corporate actions, such as stock splits, dividends, and mergers, can impact the stock's value and the historical data associated with it. For instance:

Stock Split: If a company performs a 2-for-1 stock split, shareholders receive two shares for every one they own, and the stock price is halved.

Dividend: When a company pays a cash dividend, the stock price typically decreases by the amount of the dividend.

Adjusted Close Price:

The adjusted close price is calculated by adjusting the closing price to reflect the impact of corporate actions. It provides a more accurate representation of the stock's true value over time.

The adjustment is designed to eliminate distortions in the historical price data caused by events like stock splits or dividends.

Calculation:

The adjusted close price is calculated using a formula that considers the cumulative effects of past corporate actions. The goal is to make historical prices comparable to the current market price.

For example, if a stock had a 2-for-1 stock split, the adjusted close price for each historical date before the split would be halved.

Importance in Trading:

Traders and investors use adjusted close prices to perform technical analysis, backtesting, and other historical evaluations. It helps in making informed decisions by providing a more accurate picture of the stock's performance.

Without adjustments, historical data might misrepresent the stock's value, leading to inaccurate analyses and predictions.

In summary, the adjusted close price is a modification made to the closing price of a stock to account for corporate actions, ensuring that historical data accurately reflects the stock's true value over time. This adjusted data is essential for making informed decisions in stock and options trading.