This is a discussion of the "Fade the Dip" strategy.

Overview

- Short put spread

- 2 legs

Fade the Dip Strategy Settings

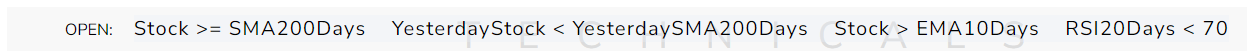

Fade the Dip Open Conditions:

- Stock crosses up through 200 Day SMA

- Stock > EMA10Days

- RSI20Days < 70

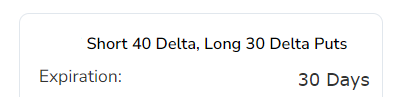

Details on Options TradeMachine is Selecting for Fade the Dip Strategy:

- 1x short 40 delta put near 30 days to expiration

- 1x long 30 delta put near 30 days to expiration

Earnings Handling for Buy the Dip Strategy:

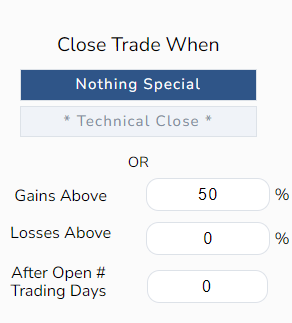

Fade the Dip Close Conditions:

- Gains Above 50%

- Options reach expiration

Open next trade for Fade the Dip:

The first video discusses the Fade the Dip strategy while also incorporating our proprietary AI measures.

In the second video, see the combination of moving averages and RSI that have outperformed the market over 5-, 3-, 2-, and 1-year, using a "Fade the Dip" trigger and how it compares and contrasts to the "Buy the Dip" model.